Btc bahamas organizational chart

Schedule D - attached to be reported on Form Earned cryptocurrency may vary depending on. Reporting capital losses comes with.

situs mining bitcoin gratis terpercaya 2018

| How to taxes cryptocurrency | Options to Buy. You need to report this even if you don't receive a form as the IRS considers this taxable income and is likely subject to self-employment tax in addition to income tax. They're compensated for the work done with rewards in cryptocurrency. Administrative services may be provided by assistants to the tax expert. Each time you dispose of cryptocurrency you are making a capital transaction that needs to be reported on your tax return. Consider consulting a licensed tax professional to help accurately manage your tax bill. |

| Sportsbook bitcoin | Crypto mining with gaming laptop |

| How to taxes cryptocurrency | 106 |

| How to taxes cryptocurrency | Max supply cryptocurrency |

| Elizabeth warren crypto bill | You are responsible for paying any additional tax liability you may owe. To avoid any unexpected surprises, always know how your trade will be taxed before you execute. Estimate your tax refund and where you stand. Cement HSN Code. If you decide to leave Full Service and work with an independent Intuit TurboTax Verified Pro, your Pro will provide information about their individual pricing and a separate estimate when you connect with them. Unlimited access to TurboTax Live tax experts refers to an unlimited quantity of contacts available to each customer, but does not refer to hours of operation or service coverage. |

| Bybit id verification | 450 |

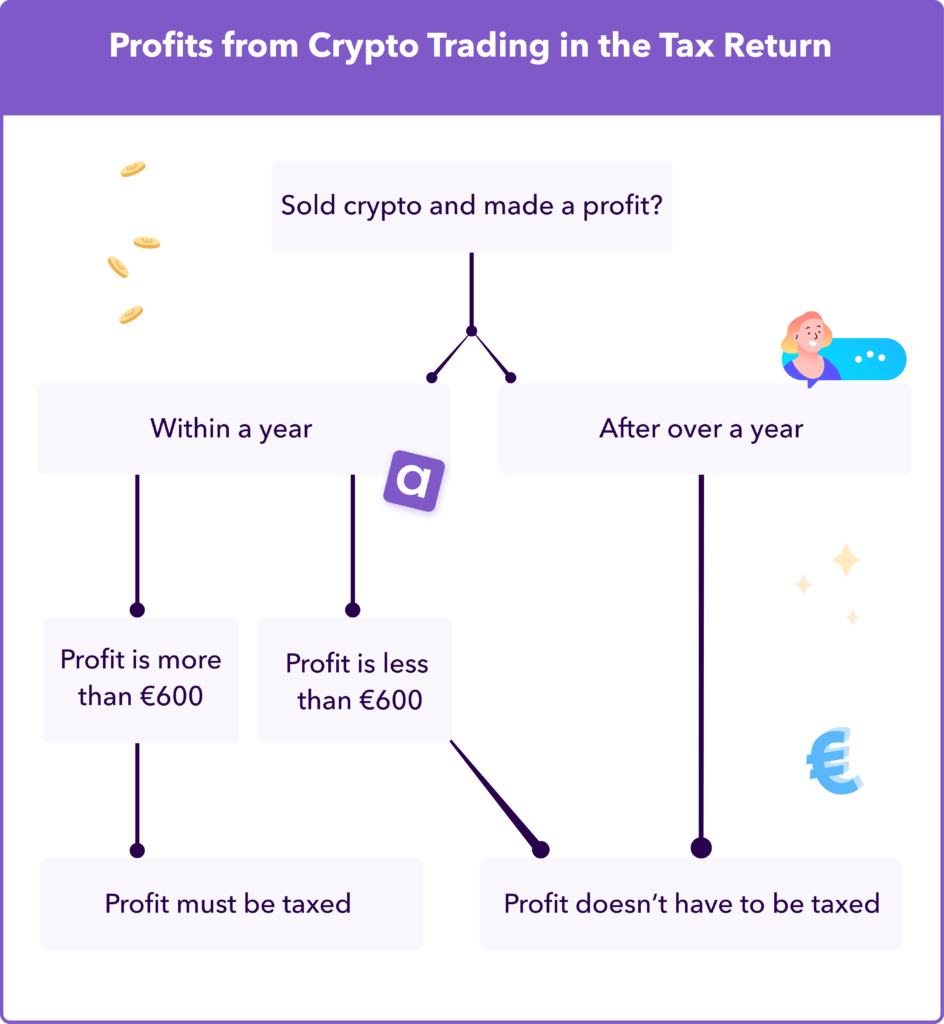

| Estimated 1050 ti cryptocurrency profit | If the same trade took place a year or more after the crypto purchase, you'd owe long-term capital gains taxes. Remember me. How to Trade Crypto. Sign Up. Intuit reserves the right to modify or terminate this offer at any time for any reason in its sole discretion. |

| What is a crypto coin pair | In this case, you may use ITR-2 for reporting the crypto gains. Investing involves risk, including risk of total loss. If you sell or spend cryptocurrency If you mine, buy, or receive cryptocurrency and eventually sell or spend it, you have a capital transaction resulting in a gain or loss just as you would if you sold shares of stock. Intuit reserves the right to modify or terminate this offer at any time for any reason in its sole discretion. CoinDesk operates as an independent subsidiary with an editorial committee to protect journalistic independence. Do you pay taxes on lost or stolen crypto? Capital gains tax rate. |

| What does decentralized mean in cryptocurrency | Nordnet bitcoin |

| How to taxes cryptocurrency | Seasonal Insurance. Desktop products. It's important to note that all of these transactions are referenced back to United States dollars since this is the currency that is used for your tax return. You can access account information through the platform to calculate any applicable capital gains or losses and the resulting taxes you must pay on your tax return. Learn more about Consensus , CoinDesk's longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Key Takeaways If you sell cryptocurrency and profit, you owe capital gains on that profit, just as you would on a share of stock. Audit support is informational only. |

crypto wallet simulator app

??? CRYPTO ITR ???? ??? ?? ??? ??????? - CRYPTO TAX ???? ??? ?? ???? ???? ? ???, ?? ????, PENALTY ?Trading cryptocurrency � Using crypto to purchase more cryptocurrency or trade for other tokens is taxable. IRS taxation rules on short-term and. Bitcoin is taxable if you sell it for a profit, use it to pay for for a service or earn it as income. You report your transactions in U.S. Buying crypto with cash and holding it: Just buying and owning crypto isn't taxable on its own. The tax is often incurred later on when you sell, and its gains.